Start

October 2021

End

January 2023

Status

Completed

GAFAM Empire. An exploration of acquisitions by big tech companies

Start

October 2021

End

January 2023

Status

Completed

Since the mid-1970s, the world has witnessed the rise and rise of the so-called Big Tech Companies, the five largest companies operating in information technology. Also called GAFAM (an acronym for Google, Apple, Facebook, Amazon and Microsoft), they have been able to build intellectual property empires of technologies and systems over the past 50 years through acquisitions of companies large and small, centralizing technological innovation in them.

In collaboration with Tactical Tech Collective, "GAFAM Empire" brings together a longform site analysis of more than 1,000 acquisitions to reconstruct a look back at the evolutionary history of this industry sector through publicly available online data. Through them, a panorama of acquisitions can be reconstructed that identifies common themes of interest, explored later in a temporal perspective in the lens of each GAFAM.

The project focused on analyzing, visualizing, and publishing data found on the web regarding acquisitions by GAFAM. Computational and non-computational data analysis activities identified areas of interest of each acquisition, and the technologies they introduced to the market.

Project details

Landscape of acquisitions

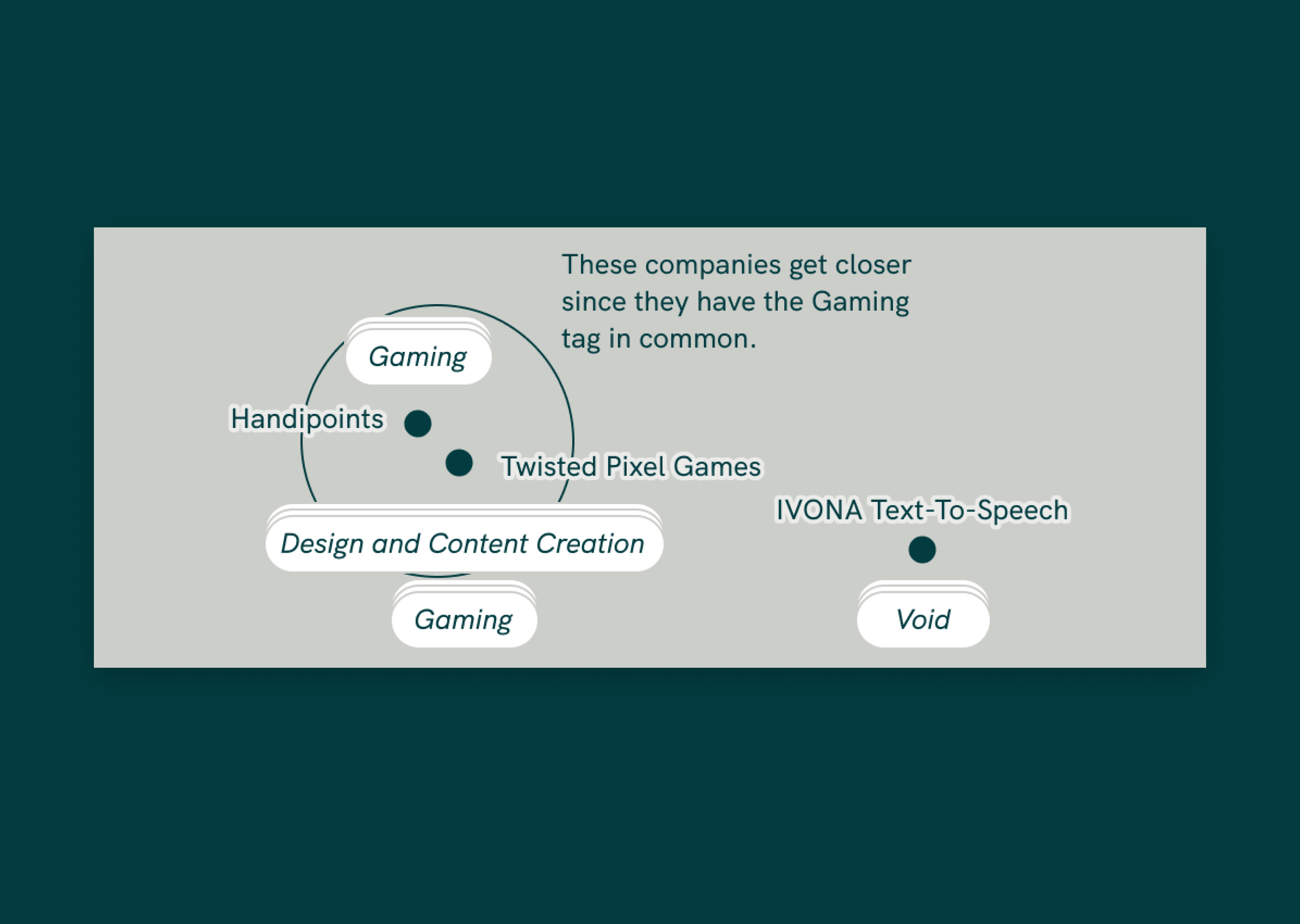

In the Landscape of acquisitions, the visualization collects clusters of acquisitions that are close to each other when described by similar tags. These tags are collected from Crunchbase, and in a preliminary data analysis phase they were unified with each other.

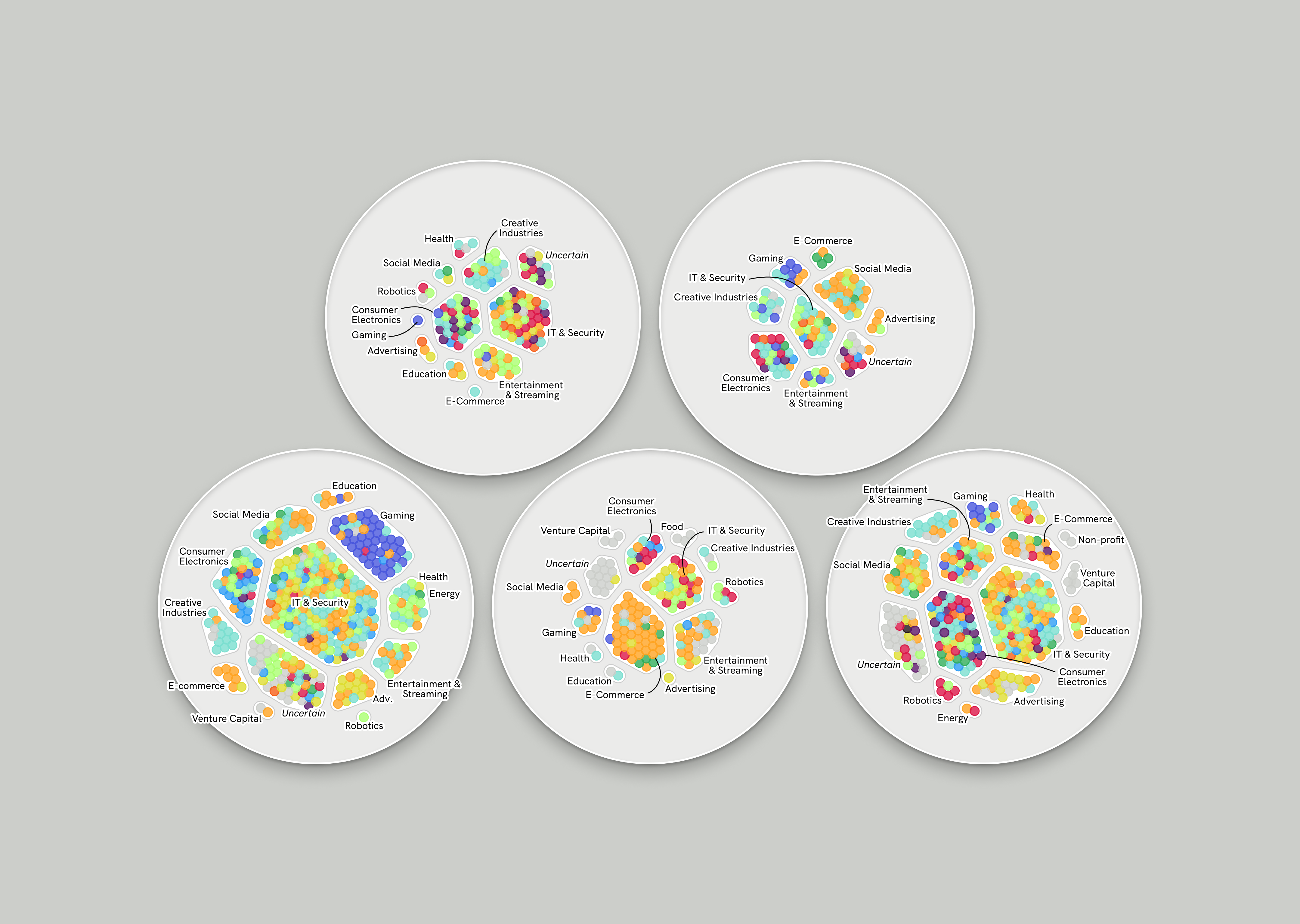

Petri Dishes

In the Petri Dishes, the visualization shows the areas of interest in GAFAM, highlighting through the colors of each acquisition the technology they bring within each company. By going to temporally analyze the evolution of the Petri dishes (which also take into account the companies that have been sold over time) it is possible to see how the investment focus of each company changes.

Timeline of acquisition

Finally, with the TimeLine, it is possible to see in detail how the acquisition of a company is not only dictated by an interest in it, but also by previous acquisitions it had made in turn. The Timeline reveals a relationship far more complex than appearance, where concatenations of acquisitions show a tendency to centralize technological innovation within GAFAM.

Research groups

DensityDesign